Global Market Size, Forecast, and Trend Highlights Over 2025-2037

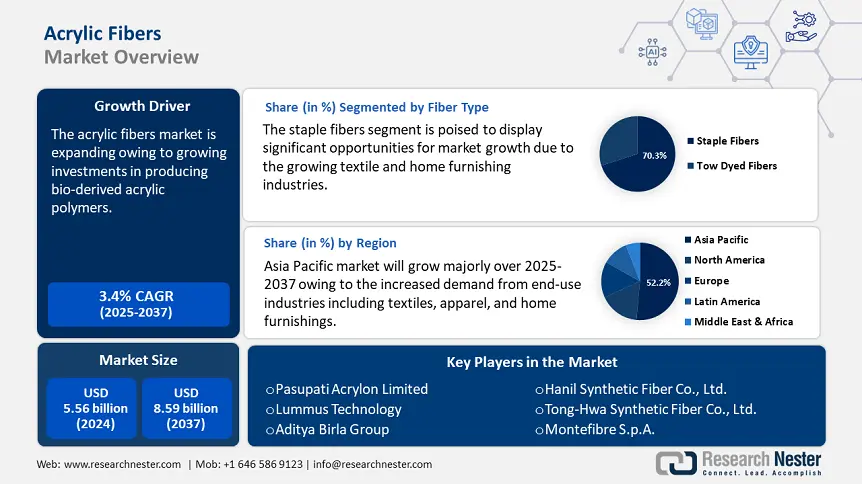

Acrylic Fibers Market size was USD 5.56 billion in 2024 and is estimated to reach USD 8.59 billion by the end of 2037, expanding at a CAGR of 3.4% during the forecast period, i.e., 2025-2037. In 2025, the industry size of acrylic fibers is assessed at USD 5.75 billion.

The global acrylic fibers market is anticipated to expand owing to the growing investments in producing bio-derived acrylic polymers. Recycling reduces the demand for virgin resources and the environmental impact of extracting and processing raw materials. Research and development efforts have produced bio-based acrylic fibers from renewable resources such as corn, sugarcane, or other plant-based materials. Several manufacturers are using environmentally friendly production methods to reduce the amount of energy, water, and emissions used in the production of acrylic fibers. Acrylic fibers can support sustainability by reducing the need for frequent replacements and extending the life of products made with them due to their reputation for strength and durability. Strategic investments in manufacturing infrastructure and sustainability initiatives, such as eco-friendly production processes and recyclable fibers, are further boosting market demand.

New product launches and investments in the acrylic fibers market are driving growth by improving product innovation, expanding applications, and improving performance characteristics. In January 2025, Arkema, a leader in specialty materials, introduced ENCOR bio-based aqueous dispersions for textile printing and finishing. These binders, with up to 30% bio-based content and up to 40% carbon footprint reduction compared to typical textile resins, help the textile sector reduce its carbon footprint and promote a sustainable lifestyle. Similarly, in April 2023, Lenzing Group, a global producer of wood-based specialty fibers, launched the first phase of the Fiber Recycling Initiative by TENCEL with mill partners Artistic Milliners from Pakistan, Canatiba from Brazil, and Textil Santanderina from Spain. The new effort aims to promote circularity in the global textile industry by producing denim fabrics made from mechanically recycled TENCEL lyocell fibers.

Acrylic Fibers Market: Growth Drivers and Challenges

Growth Drivers

- Advancements in acrylic fiber technology: The objective of innovations in the production of acrylic fibers has been to enhance the comfort and softness of these fibers, thereby increasing their desirability for use in various clothing items, such as sportswear, socks, and sweaters. These advancements not only extend the lifespan of acrylic fibers but also enhance their suitability for a diverse range of applications, including upholstery, carpets, and industrial uses. Acrylic fibers have become more resistant to abrasion, stretching, and tearing due to these improvements. Additionally, advancements in dyeing techniques and additives have significantly bolstered the exceptional color retention and fade resistance of acrylic fibers. Furthermore, innovations in acrylic fiber technology have also aimed to reduce the environmental impact of production processes, aligning with the increasing emphasis on sustainability within the industry.

- Increasing demand for apparel: Revenue growth within the acrylic fibers market is projected to be propelled by the increasing utilization of acrylic fibers in blended textiles along with other materials such as cotton and wool. The process of blending significantly enhances the absorption, durability, and overall performance of the final fabric. For instance, the combination of wool with acrylic fibers results in a product that possesses improved resilience and flexibility. As the quality and durability of acrylic fibers continue to evolve, businesses will encounter expanded opportunities to penetrate previously underserved acrylic fibers markets. Furthermore, the trend of online purchasing for these items has gained momentum, attributed to the convenience of product browsing and accessibility. The COVID-19 pandemic has intensified this trend, as social distancing measures and a lifestyle centered around staying at home have led to a notable increase in e-commerce transactions within the furniture and textile sectors.

Furthermore, as personal incomes rise, per capita spending on apparel tends to grow, driving demand for diverse clothing options where acrylic fibers play a key role due to their affordability, durability, and versatility. Additionally, in developing nations experiencing rapid GDP growth, expanding middle-class populations contribute to higher demand for stylish, cost-effective clothing, further boosting the acrylic fibers market. As per recent studies, the number of middle-class households in emerging countries is expected to double, from 354 million in 2024 to 687 million in 2034.

Challenges

- Fluctuating oil prices: Because acrylic fibers—also referred to as acrylonitrile—are made from petrochemical raw materials and processed using crude oil, their costs are influenced by changes in oil prices, issues with the supply chain, and the effects of trade restrictions. As trade hostilities between the U.S. and several other nations intensified during February, the macroeconomic conditions that support estimates of oil demand worsened. Macro risks shifted to the negative due to new U.S. tariffs and intensifying retaliatory actions. In March 2025, the International Energy Agency revealed that as trade tensions escalated and economic sentiment soured, oil prices fell by roughly USD 7/bbl in February and early March, casting doubt on the expansion of oil demand. Therefore, manufacturers have production issues as a result of the direct impact that raw material prices have on manufacturing costs and wholesale prices.

- Environmental issues and intense competition from alternatives: Due to its chemical-intensive dyeing methods and byproduct microplastics, the synthetic textile industry has come under fire. Manufacturers are being urged to adopt eco-friendly production practices or transition to biodegradable fiber alternatives by the current regulations governing waste management, pollution control, and environmentally friendly textile production. Additionally, polyester, nylon, and wool are becoming competitive with acrylic fibers since they are less expensive and have similar performance characteristics. The acrylic fibers market is already under pressure from the growing demand for textiles made from plants, recycled materials, and biodegradable materials. Therefore, these factors are impeding the growth of the acrylic fibers market.

Acrylic Fibers Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

3.4% |

|

Base Year Market Size (2024) |

USD 5.56 billion |

|

Forecast Year Market Size (2037) |

USD 8.59 billion |

|

Regional Scope |

|

Acrylic Fibers Segmentation

Fiber Type (Staple Fibers, Tow Dyed Fibers)

Staple fibers segment is expected to dominate around 70.3% acrylic fibers market share by the end of 2037. Staple fiber is the term used in the acrylic fiber business to describe acrylic fibers produced in short lengths, usually a few millimeters to several inches. Many textiles, such as blankets, rugs, furniture, and clothing, are commonly made from these fibers. Among their many advantages, acrylic staple fibers are long-lasting, soft, and resistant to fading, mildew, and moths. Staple fibers are made by wet spinning, sometimes referred to as dry spinning. Fibers are created by dissolving acrylic polymer in a solvent and then extruding it through spinnerets. These strands are then chopped into short lengths to form staple fibers.

Application (Apparel, Home Textiles, Nonwoven Fabrics, Industrial & Technical Textile, Carpet & Rugs, Outdoor & Recreational Products, Upholstery, Blankets & Bedding, Craft & Hobby)

The apparel segment in acrylic fibers market is anticipated to garner a significant share during the assessed period. Acrylic fibers are widely used in the clothing industry due to their characteristics and versatility. Warmth, softness, resistance to chemicals and sunlight, and durability are some advantages of acrylic fibers. Acrylic fibers are commonly used in cardigans and sweaters because they are warm and fuzzy and feel like wool but are less expensive. Acrylic fibers are frequently mixed with other materials to create warm and comfortable socks and stockings. They are ideal for everyday wear owing to their capacity to provide warmth and wick away sweat. Sportswear and athletic gear use acrylic fibers as they stretch and wick away moisture. They keep the wearer dry and comfortable during exercise.

Our in-depth analysis of the acrylic fibers market includes the following segments:

|

Fiber Type |

|

|

Application |

|

|

End use |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportAcrylic Fibers Industry - Regional Synopsis

APAC Market Statistics

Asia Pacific in acrylic fibers market is expected to account for around 52.2% revenue share by 2037. The market for acrylic fibers within the region has been growing rapidly, mostly as a result of increased demand from end-use industries including textiles, apparel, and home furnishings. Countries including China, India, and Japan were major contributors to this rise, with their extensive textile production bases and thriving industrial sectors playing a major role. Acrylic fibers are utilized in many items, including outdoor fabrics, carpets, blankets, and clothing, due to their well-known properties of warmth, softness, and resistance to chemicals and sunlight. The region's growing population, increasing disposable income, and changing consumer preferences have all contributed to the need for acrylic fibers.

China is benefiting from the strong demand for apparel, carpets, technical textiles, and insulation materials as the world's largest producer of acrylic fibers. The country is using its sophisticated synthetic textile industry, economical manufacturing methods, and emerging markets to become one of the world's leading suppliers of acrylic-based yarn and fiber. China exports acrylic fibers to countries such as Iran, India, and UAE. The country’s dominance in the acrylic fibers market is expected to persist, supported by its robust textile manufacturing capabilities and strong domestic and international demand.

The World Integrated Trade Solution (WITS) reported that China exported USD 9,769,750 kg of acrylic or modacrylic synthetic staple fibers, valued at USD 20,398.43K. The table below shows the acrylic and modacrylic synthetic staple fibers exports from Japan in 2023:

|

Importers |

Trade Value (in thousand USD) |

Quantity (kg) |

|

UAE |

9,042.84 |

5,219,510 |

|

Indonesia |

2,523.00 |

1,046,110 |

|

Vietnam |

2,019.27 |

875,044 |

|

Italy |

1,754.63 |

423,214 |

|

Russian Federation |

976.18 |

183,194 |

Source: WITS

Due to the growing garment sector, rising disposable income, and government initiatives including Make in India and Atmanirbhar Bharat, India has become one of the world's fastest-growing textile producers. The combined trend of sportswear and winterwear is leading to the use of acrylic-blended textiles, synthetic wool alternatives, and moisture-wicking thermal fabrics. The expanding Indian home textiles sector, which includes carpets, rugs, blankets, and upholstery, is another factor driving market expansion.

North American Market Analysis

North America acrylic fibers market is expected to grow at a significant rate during the projected period. The demand for acrylic fiber in the textile industry, which encompasses clothing, home furnishings, industrial applications, and technical textiles, has resulted in a predominantly medium-sized sector in North America. Consumers are increasingly seeking affordable, durable, and easy-to-maintain fabric options. Currently, the U.S. and Canada are experiencing a significant trend toward the adoption of premium winter outdoor apparel, thermal blankets, athletic wear, and lightweight synthetic textiles. In addition to using acrylic yarns for insulation, cold-weather outerwear, and various accessories, the region's typically dry, cold, and unpredictable climate has further stimulated preferences for knitting, wearing, and securing these items.

Furthermore, more sophisticated fabric qualities including UV resistance, moisture resistance, and fade resistance are in demand by the upholstery, outdoor furniture, and automotive industries. These fabrics are used in the production of convertible car tops, sunshades, awnings, and patio furniture.

The development of bio-based acrylic fibers, recycled polymer solutions, and low-emission dyeing techniques are the main investments in the textile industry's green transition. The acrylic fibers market in the area is significantly shaped by government rules that support energy-efficient textile production, low-carbon manufacturing, and the reduction of pollution from synthetic waste.

Companies Dominating the Acrylic Fibers Market

- Pasupati Acrylon Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lummus Technology

- Aditya Birla Group

- Hanil Synthetic Fiber Co., Ltd.

- Tong-Hwa Synthetic Fiber Co., Ltd.

- Montefibre S.p.A.

- Formosa Plastics Corp

- Zhejiang Hangzhouwan Acrylic Co., Ltd.

- Aksa Akrilik Kimya Sanayii A.S.

- Dralon GmbH

To improve their acrylic fibers market positions and satisfy changing customer demands, industry leaders are concentrating on sustainable production, product diversity, and strategic alliances. Furthermore, there are a lot of potential prospects due to the growing use of acrylic fibers in high-performance industrial applications such as geotextiles, filtering media, and automobile interiors. Changing consumer preferences, such as a growing desire for easy-care textiles that provide durability and visual appeal without requiring an excessive amount of upkeep, are another factor propelling acrylic fibers market rise. Manufacturers are now able to create vivid, long-lasting colors that are resistant to deterioration in the environment thanks to advancements in fiber dyeing and finishing procedures.

In the News

- In October 2023, Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced that it signed an agreement with Air Liquide Engineering & Construction to license and market ester-grade acrylic acid technology, as well as light and heavy acrylate process technology. The expansion broadens Lummus' portfolio of propylene production and derivative products, giving clients more alternatives for upstream and downstream operations.

- In June 2023, Birla Cellulose, a subsidiary of Grasim Industries Limited and a member of the Aditya Birla Group, proudly presents its latest innovation, Birla SaFR, at ITMA 2023 in Milan, Italy. This ground-breaking innovation represents a significant milestone in Birla Cellulose's strategic ambition to provide materials for the technical textile industry.

Author Credits: Rajrani Baghel

- Report ID: 7408

- Published Date: Mar 27, 2025

- Report Format: PDF, PPT