Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Ammonium Acetate Market size was USD 9.84 billion in 2024 and is estimated to reach USD 15.39 billion by the end of 2037, expanding at a CAGR of 3.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of ammonium acetate will be valued at USD 10.18 billion.

The global ammonium acetate market is expanding significantly due to the increasing demand for processed and packaged food products, increasing population, and shifting dietary habits. According to the United Nations Conference on Trade & Development (UNCTAD) between 2000 and 2021, the value of the world's food commerce increased by 350% to USD 1.7 trillion. Compared to 6% in 2000, food accounts for around 8% of global goods trade. Ammonium acetate is widely used to improve the flavor, texture, and shelf life of a variety of food products, such as baked goods, confections, and beverages. Further, the market is expanding due to the growing use of ammonium acetate as a secure and efficient preservative in food items. In the upcoming years, there will likely be a significant increase in demand for ammonium acetate due to the global expansion of the food and beverage industry.

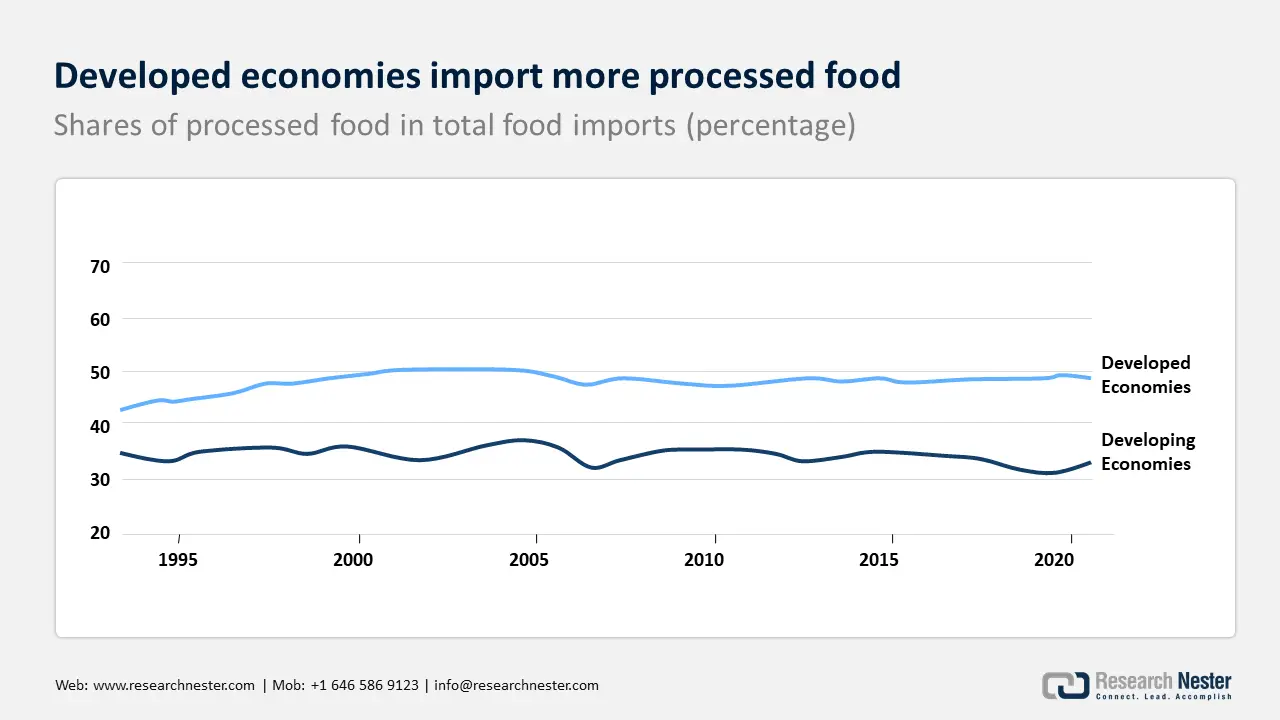

Furthermore, the growth of processed food consumption is expected to drive the ammonium acetate market. Ammonium acetate is used in the food industry as an acidity regulator, pH control agent, and preservative in various processed food products. With the growth of the global processed food trade, there is an increasing demand for food products that maintain their freshness and quality during transportation and storage. Developed economies tend to import more processed food compared to developing economies. This is due to higher consumer demand, advanced supply chains, diverse consumer preferences, stringent food safety standards, and higher purchasing power.

Ammonium Acetate Market: Growth Drivers and Challenges

Growth Drivers

- Increasing demand from the pharmaceutical industry: Ammonium acetate is a crucial chemical compound that holds significant importance in the pharmaceutical industry. Its applications extend to various medicinal uses, including drug manufacturing, chemical medications, and traditional Chinese patent medicines, which have experienced rapid development over time. This growth exemplifies the trajectory of a developing economy.

Moreover, the Government of China has raised concerns regarding the security of pharmaceuticals, which is anticipated to result in an increased demand for high-quality ammonium acetate. Numerous companies are investing in advancements within the pharmaceutical sector, recognizing its substantial growth potential. The rising prevalence of diabetes and the extensive application of ammonium acetate in insulin production are contributing to a global escalation in demand for this compound. The World Health Organization (WHO) reported that by 2022, there were 830 million diabetics worldwide, up from 200 million in 1990. Compared to high-income countries, prevalence has been increasing more quickly in low- and middle-income countries. - Growing advances in the agricultural sector: Ammonium acetate, which is produced when ammonia and acetic acid react, is highly sought after in the agricultural industry for use in fertilizers, insecticides, and other products. This is because it aids in the crop's root development and is essential to synthesis processes. The demand for fertilizer and pesticides, increased output of grains and cereals, and government initiatives to support agricultural development programs are all contributing causes to the agriculture industry's notable prosperity.

Furthermore, recent research demonstrated that improving torula yeast borax bait with ammonium acetate significantly improves the capture rates of certain economically important fruit fly species. In field experiments conducted in Hawaii, traps baited with a 1% ammonium acetate-supplemented solution captured significantly more Ceratitis capitate and Bactrocera dorsalis compared to those with standard torula yeast borax solution. These findings suggest that ammonium acetate with existing bait formulations can improve surveillance and control programs for these pests. Therefore, the increased demand for more effective fruit fly attractants is contributing to the growth of the ammonium acetate market.

Challenges

-

Health-related concerns: Ammonium acetate has been linked to serious environmental and health risks. High health risks are indicated by the ammonium acetate safety data sheets, or SDS. It causes health problems like skin irritations, eye rashes, nose irritations, and mouth irritations. Furthermore, the chemical causes issues with the gastrointestinal and respiratory systems upon contact. Ammonium acetate's toxicity also affects the environment, posing a hazard to aquatic life and causing water poisoning. As a result, the market for ammonium acetate expects a significant slowdown and growth challenge due to the volatility and associated risks.

- Stringent regulations and laws: Ammonium acetate poses a risk of eutrophication when released into the environment, which can disrupt aquatic ecosystems and diminish soil quality by depleting oxygen levels. To ensure safe handling and environmental protection, regulatory bodies, such as the European Union's REACH regulation, necessitate comprehensive data on chemicals, including ammonium acetate. The increasing consumer awareness of environmental impacts is impeding market expansion, leading to a rising demand for natural alternatives to synthetic additives like ammonium acetate.

To address these challenges, industry participants must invest in research and development focused on environmentally sustainable production methods and formulations. Compliance with evolving regulations and meeting consumer expectations for sustainable products will be critical for the long-term viability and growth of the market.

Ammonium Acetate Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

3.5% |

|

Base Year Market Size (2024) |

USD 9.84 billion |

|

Forecast Year Market Size (2037) |

USD 15.39 billion |

|

Regional Scope |

|

Ammonium Acetate Segmentation

Grade (Industrial Grade, Agriculture Grade, Medical Grade, Food Grade)

Medical grade segment is estimated to capture ammonium acetate market share of over 36.3% by 2037. Ammonium acetate's high purity and consistency are essential in analytical chemistry, especially in mass spectrometry, making it indispensable for drug development and biomarker analysis. The increased demand for pharmaceuticals, particularly during the COVID-19 pandemic, and the global focus on healthcare have increased the need for dependable and high-quality reagents. The World Health Organization (WHO) projects that the preparation for potential future pandemics will incur an annual cost of approximately USD 31.1 billion, with roughly one-third of this amount anticipated to originate from international funding sources. In the year 2020, global health expenditures surged by nearly USD 9 trillion, primarily due to temporary increases in government spending necessitated by the response to the pandemic. This expenditure represents roughly 11% of global Gross Domestic Product (GDP), with approximately sixty-three percent derived from public funding.

As a result, the medical grade segment has become a major driver of the ammonium acetate market, meeting the strict requirements of the pharmaceutical and healthcare sectors. Thus, the medical grade segment holds a significant share of the ammonium acetate market.

Sales Channel (Food & Beverages, Medical & Pharmaceutical, Cosmetics & Personal Care, Agriculture, Chemical, Textile)

The medical & pharmaceutical segment in ammonium acetate market is poised to garner a significant share during the assessed period. The medical and pharmaceutical sector dominates the ammonium acetate market due to its significance in drug development and analytical chemistry. In the pharmaceutical industry, ammonium acetate is essential for the accurate analysis of complex biomolecules using mass spectrometry and analytical research.

Great purity ammonium acetate is still in great demand due to the continuous development and innovations in the biotechnology and pharmaceutical sectors. Its reputation for producing accurate and dependable findings in analytical techniques highlights its indispensable value in pharmaceutical research, quality assurance, and biomarker identification, securing its leading position in this particular end-use industry.

Our in-depth analysis of the global ammonium acetate market includes the following segments:

|

Grade |

|

|

Application |

|

|

Sales Channel |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportAmmonium Acetate Industry - Regional Synopsis

North America Market Statistics

North America in ammonium acetate market is set to dominate around 38.5% revenue share by the end of 2037. Ammonium acetate is essential to the region's firmly established pharmaceutical and biotechnology industries for precision-driven analytical chemistry and state-of-the-art research. The region's steadfast adherence to strict environmental laws and preference for ecologically friendly chemical solutions, such as ammonium acetate, strengthen its position. Furthermore, the demand for fertilizers based on ammonium acetate is driven by North America's booming agriculture sector. North America's dominant position in the ammonium acetate market is supported by the region's economic strength, continuous commitment to research and development initiatives, and prevalent emphasis on sustainability.

In the U.S., the robust pharmaceutical industry utilizes ammonium acetate in drug formulations, notably in the production of insulin and penicillin. The increasing prevalence of diabetes has expanded the diabetic patient pool, significantly elevating the demand for insulin and, consequently, ammonium acetate. According to the U.S. Centers for Disease Control and Prevention, there are over 38 million diabetics worldwide. That's around one out of ten persons.

One in five persons are unaware that they have it. More than one in three adults in America, or 98 million people, have prediabetes. Over 80% of adults with prediabetes are unaware that they have the condition. Additionally, the compound’s application as a food additive and acidity regulator in the food and beverage sector contributes to the ammonium acetate market growth.

In Canada, the pharmaceutical industry utilizes it as a buffering agent in drug formulations, benefitting from Canada’s strong healthcare sector. Additionally, the food processing industry employs ammonium acetate as a preservative and acidity regulator, aligning with the nation’s emphasis on food safety and quality. For instance, Health Canada is in charge of establishing guidelines and requirements for the safety and nutritional value of every food that is sold in Canada. To create and carry out regulations under the FDA and its related policies and standards, the Food Directorate, which is part of the Health Products and Food Branch, assesses scientific data to manage the health risks and benefits of food products. For early identification, monitoring, and surveillance, they also carry out food-borne disease surveillance.

APAC Market Analysis

Asia Pacific ammonium acetate market is expected to grow at a significant rate during the projected period. The strong agriculture sector and expanding industrial activity in the Asia Pacific are the main drivers of the region's growth in the ammonium acetate industry. Ammonium acetate-based fertilizers are essential to the region's large agricultural operations, which sustain demand. Ammonium acetate is also widely used in research and manufacturing by the rapidly growing chemical and pharmaceutical sectors in Asia Pacific, which increases consumption even further. The region is a major ammonium acetate market due to its affordable manufacturing capacity, expanding population, and urbanization. Furthermore, the region's numerous ammonium acetate producers boost its market share by serving local and foreign consumers, solidifying its position as the industry leader.

Furthermore, the Government of China highly focuses on pharmaceutical safety, further amplifying the demand for high-grade ammonium acetate. Additionally, the compound’s applications in chemical synthesis and the food and beverage sector contribute to its increased utilization. Also, in India, the agriculture sector benefits from its use in fertilizers and pesticides, improving crop yield and pest control. Additionally, the textile industry also uses it for dyeing and printing processes. These applications, coupled with India’s growing industrial base and increasing export activities, are propelling the ammonium acetate market in the country.

For instance, the Observatory of Economic Complexity revealed that India was the 58th largest fertilizer exporter in the world in 2023, with USD 177 million in exports. Fertilizers were India's 81st most exported product that year. India's top three export destinations for fertilizers between 2022 and 2023 were Zambia (USD 3.66M), Brazil (USD 7.24M), and Nepal (USD 40.5M). Leading businesses including Walmart (4), At Home Procurement (3), and Givaudan Fragrances (3) were also at the forefront of the fertilizer shipment industry from India to the US in 2023.

Below is the table indicating the export value of fertilizers from India in 2023:

|

Country |

Export Value of Fertilizers (in USD million) |

|

Nepal |

60.4 |

|

U.S. |

22.7 |

|

Brazil |

14.4 |

|

Chinese Taipei |

9.59 |

|

Mozambique |

7.18 |

Source: OEC

Companies Dominating the Ammonium Acetate Market

- Niacet Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jarchem Innovative Ingredients LLC

- INEOS Acetyls

- Celanese Corporation

- Wuxi Yangshan Biochemical Co., Ltd.

- Langfang Tianke Biotechnology Co., Ltd.

- Guangzhou Runhong Pharmaceutical Technology Co., Ltd.

- Weifang Yafeng Chemical Instrument Co., Ltd.

- Tianmen Chutian Fine Chemical Co., Ltd.

- Jiangsu Jiatai Chemical Co., Ltd.

Leading companies in the ammonium acetate market are heavily investing in R&D to create new products, diversify their product lines, and investigate unexplored markets to keep their competitive advantage in the market. To maintain market dynamics, major competitors in the ammonium acetate market are using a variety of tactics, including partnerships, acquisitions, and cooperation. Since it is expected that the industry will be extremely competitive in the upcoming year, market participants are turning to product innovation and ongoing consumer needs for support.

In the News

- In November 2024, INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) signed a memorandum of understanding to investigate the feasibility of constructing a new world-scale, 600kt acetic acid facility at GNFC's site in Bharuch, Gujarat, India.

- In June 2024, Celanese Corporation, a global chemical and specialty materials company, declared a force majeure and sales control for acetic acid and vinyl acetate monomer (VAM) sold in the Western Hemisphere. This comes as a result of intensifying force majeure conditions and operational failures experienced by multiple suppliers of critical raw materials essential to Celanese’s production of these products.

Author Credits: Rajrani Baghel

- Report ID: 7319

- Published Date: Mar 10, 2025

- Report Format: PDF, PPT