Global Market Size, Forecast, and Trend Highlights Over 2025-2037

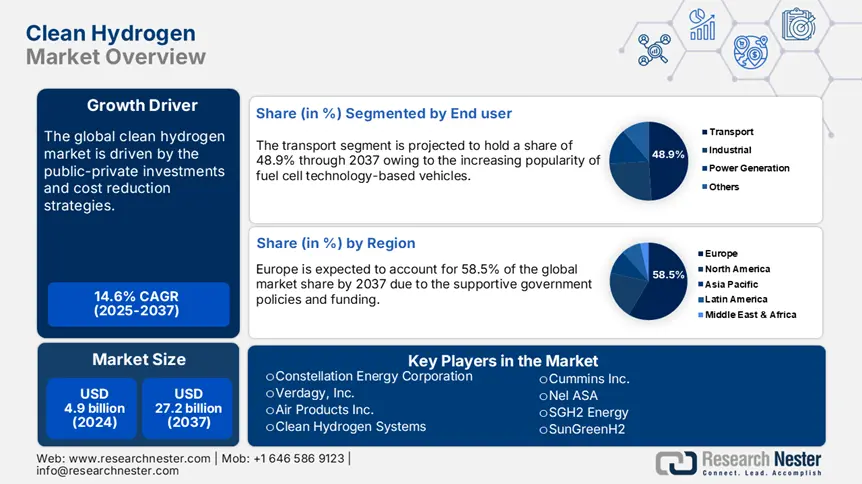

Clean Hydrogen Market size was USD 4.9 billion in 2024 and is estimated to reach USD 27.2 billion by the end of 2037, expanding at a CAGR of 14.6% during the forecast period, i.e., 2025-2037. In 2025, the industry size of clean hydrogen is assessed at USD 5.6 billion.

The Paris Agreement and clean energy transitions are emerging as game changers for clean hydrogen trade. Clean hydrogen’s decarbonization movement in energy systems is set to contribute significantly to the world's economy in the coming years. The International Energy Agency (IEA) study states that the global hydrogen demand was calculated at 97 Mt in 2023. The consumption of hydrogen was registered mainly in the refining and chemical sectors. With technological advancements, the scope of hydrogen is expected to expand in transport, industrial, and power generation fields. The net-zero emission by 2050 goal is poised to account for 40.0% of the global hydrogen demand through 2030. The growth in implementation of these policies is set to scale the low-emission hydrogen production and consumption in the coming years.

The green transformation is estimated to increase the importance of hydrogen in energy production. The renewable electricity generation across the world is set to amount to more than 17000 terawatt-hours (TWh) by 2030, with China and the U.S leading the power demand. The share of hydropower in all renewables is expected to be 14.2% in 2025. The increasing demand for clean energy superpowers is anticipated to uplift the hydrogen consumption in the years ahead. The global green energy market is foreseen to increase from USD 128.5 billion in 2025 to USD 379.2 billion by 2037.

Clean Hydrogen Market: Growth Drivers and Challenges

Growth Drivers

- Rise in public-private investments: The increasing public-private investments in the clean hydrogen projects are likely to increase their trade cycle in the coming years. The governments worldwide are also offering positive support through schemes, policies, subsidies, and grants to boost clean hydrogen production. Several countries’ increasing investment plans in clean energy transitions are also set to boost the consumption of clean hydrogen in the years ahead. The U.S. Department of Energy (DOE) reveals that in September 2022, around 7.0 billion was invested in clean hydrogen. Further, the Fuel Cell and Hydrogen Energy Association (FCHEA) states that in 2021, around USD 8 billion was allocated for the development of Regional Clean Hydrogen Hubs through the Infrastructure Investment and Jobs Act (IIJA), mainly focusing on the enhancement of hydrogen production, distribution, and storage.

- Cost reduction strategies to uplift clean hydrogen demand: The low-emission hydrogen captured nearly 1.0% of the total hydrogen production in 2023, a hike of 6% from previous years, according to estimates by the IEA. The low-emission hydrogen manufacturing is owing to the 700 MW of electrolysis and over 10 kt H2/year production capacity from natural gas with CCUS and biomass, particularly from the Prince George refinery project located in Canada. Furthermore, the cost reduction strategies are set to boost the consumption of clean hydrogen in the coming years. The know-how strategies of China are expected to drive cost-effective innovations in clean hydrogen electrolyzer.

Challenges:

- Clean hydrogen production is an energy-intensive process: The versatility of hydrogen produced using fossil fuels such as coal and natural gas is expected to be hampered by strict carbon emission regulations. Furthermore, the process of producing clean hydrogen through electrolysis and using it in fuel cells is an energy-intensive process. The production, storage, and transportation require considerable energy input, which increases the chances of carbon emission, challenging the clean movement.

- High CAPEX requirements: The clean hydrogen plants require high CAPEX for production, storage, and transportation infrastructure. The building of necessary infrastructure, such as pipelines, storage facilities, and refueling stations, needs high investment, which drives the final product costs. The construction of new clean hydrogen manufacturing plants is also a time-consuming process, and due to this, many small-scale investors are hindered from entering these projects, lowering the overall clean hydrogen market growth.

Clean Hydrogen Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

14.6% |

|

Base Year Market Size (2024) |

USD 4.9 billion |

|

Forecast Year Market Size (2037) |

USD 27.2 billion |

|

Regional Scope |

|

Clean Hydrogen Segmentation

Type (Alkaline Electrolyzer, PEM Electrolyzer, SOE Electrolyzer)

The alkaline electrolyzer segment is estimated to hold a dominant clean hydrogen market share throughout the forecast period. Alkaline electrolyzers vital role in green hydrogen production, owing to a high focus on decarbonization and reducing reliance on fossil fuels, which is contributing to its sales growth. The cost-effectiveness of alkaline electrolyzers compared to their counterparts is also a major factor in their increasing demand. Furthermore, the maturity of this technology draws the attention of end users to the installation of alkaline electrolyzers for efficient clean hydrogen production activities. Furthermore, technological advancements are set to boost the sales of improved alkaline electrolyzers in the coming years.

End user (Transport, Industrial, Power Generation, Others)

Transport segment is set to hold over 48.9% clean hydrogen market share by the end of 2037. The increasing demand for hydrogen fuel cells as a source of fuel in the automotive sector is contributing to the transport segment's growth. The electrification of passenger vehicles, trucks, buses, trains, and ships is significantly augmenting the use of clean hydrogen in energy storage technology production. The transport sector is the major contributor to greenhouse gas emissions, and the integration of hydrogen fuel cell technology in zero-emission vehicles is set to aid in meeting climate commitments and align with the Paris Agreement. The ongoing advancements in the use of clean hydrogen in the aviation and maritime sectors are further anticipated to drive the overall market growth.

Our in-depth analysis of the clean hydrogen market includes the following segments:

|

Type |

|

|

End user |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportClean Hydrogen Industry - Regional Scope

Europe Market Forecast

By 2037, Europe clean hydrogen market is set to dominate over 58.5% revenue share. The strict environmental regulations and climate commitments are primarily fueling the clean hydrogen production. The propelling demand for clean hydrogen is pushing trade and infrastructure development activities. The IEA report highlights that 75.0% of projects target Europe as the most vital market. Continuous advancement in port infrastructure and pipelines is set to boost Europe's position in the global landscape in the coming years. The report by Hydrogen Europe estimates that the region expects a supply of 2.5 Mt to 4.4 Mt of clean hydrogen by 2030, owing to funding and pan-European infrastructure development actions.

The strict regulatory framework and net-zero emission goals are augmenting the demand for clean hydrogen production technologies in the U.K. In 2022, the government announced the launch of the Low-Carbon Hydrogen Standard, and in 2023, consultation for a certification scheme was introduced. Such initiatives by the government are augmenting the clean hydrogen production in the country. Furthermore, the Electrolytic Allocation Round to support projects is set to drive the overall clean hydrogen market growth in the U.K.

Germany is likely to witness increasing demand for clean hydrogen in the coming years due to the increasing number of projects. According to the Research Nester analysis, the country is expected to have over 100 hydrogen-producing projects by 2033. The increasing importance of green transformation and innovations in electric vehicle production is set to fuel the consumption of clean hydrogen in the coming years.

North America Market Statistics

The North America clean hydrogen market is forecast to increase at the fastest CAGR between 2025 to 2037. The supportive government policies in the form of schemes, incentives, and funding are set to boost the clean hydrogen production in the U.S. and Canada. The increasing industrial demand for hydrogen is expected to drive lucrative opportunities for key market players. The booming renewable energy expansion activities are likely to uplift the clean hydrogen production in the region. Furthermore, technological advancements aimed at increasing domestic capabilities are offering high-earning opportunities for investors.

The government grant and funding support are estimated to offer double-digit percent revenue growth to clean hydrogen producers in the coming years in the U.S. The U.S. Department of Energy (DOE) states that the state-level and federal incentives included in the Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA) are set to make clean hydrogen cost-competitive to fossil-based counterparts. The same source also estimates that in 2024, the clean hydrogen production capacity stood at 14 MMTpa.

Canada’s clean hydrogen strategy, focusing on low-carbon hydrogen production, is poised to boost the overall clean hydrogen market growth during the foreseeable period. The net-zero emission by 2050 goal is increasing interest in clean hydrogen production and export trade. The report by Natural Resources Canada states that nearly 80 low-carbon hydrogen production projects have been announced in the country, creating a lucrative environment for investors. The cross-border investments are also backing the country’s clean hydrogen market growth.

Companies Dominating the Clean Hydrogen Market

- Constellation Energy Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Verdagy, Inc.

- Air Products Inc.

- Clean Hydrogen Systems

- Cummins Inc.

- Nel ASA

- SGH2 Energy

- SunGreenH2

- Lindeplc

- Air Liquide

- Engie

- Symbio

- ACWA Power

- HyPoint

- Enapter

- Hyon

- Ballard Power Systems

The companies in the clean hydrogen market are estimated to earn high revenues in the emerging markets such as Asia Pacific, the Middle East & Africa, and Latin America, owing to the growing demand for a clean energy mix. The strategic collaborations between public entities, private companies, and research institutions are set to accelerate clean hydrogen production. Public-private funding strategies are likely to fuel the green hydrogen demand and consumption in multiple sectors. Furthermore, the adoption of organic strategies is set to offer double-digit percent revenue growth in the years ahead.

Some of the key players include in clean hydrogen market:

In the News

- In March 2025, Verdagy, Inc. selected Black & Veatch for a front-end engineering Design (FEED) study for its 9,000 tons/year (60-megawatt) clean hydrogen plant in Texas. The project estimates a targeted FEED completion by May 2025 and final investment decision (FID) by July 2025.

- In October 2023, Constellation Energy Corporation revealed that it had been recently selected for up to USD 1.0 billion by the Department of Energy (DOE) as part of the bipartisan Infrastructure Investment and Jobs Act. Being a major participant in the MachH2 hydrogen hub, the company aims to invest some portion of the grant in the building of the world’s largest nuclear-powered clean hydrogen production facility at its LaSalle Clean Energy Center in Illinois, with a projected clean hydrogen production of 33450 tons each year.

Author Credits: Dhruv Bhatia

- Report ID: 7439

- Published Date: Apr 03, 2025

- Report Format: PDF, PPT