Global Market Size, Forecast, and Trend Highlights Over 2025-2037

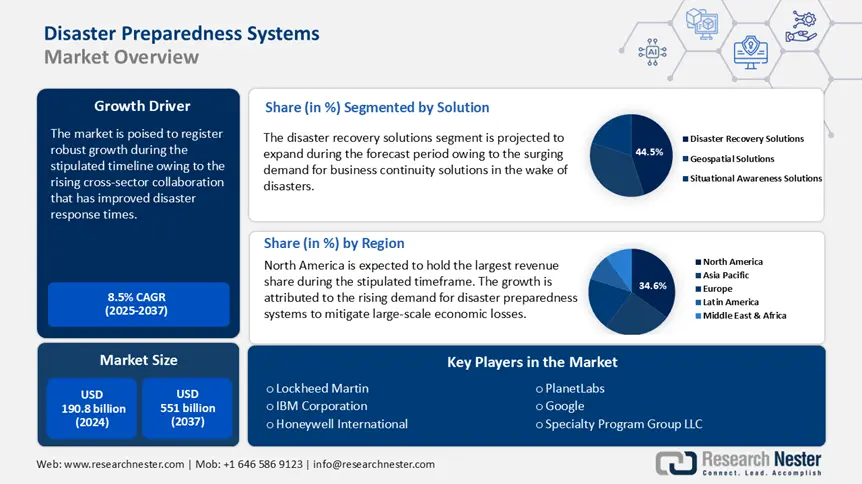

Disaster Preparedness Systems Market size was valued at USD 190.8 billion in 2024 and is set to exceed USD 551.02 billion by 2037, registering over 8.5% CAGR during the forecast period i.e., between 2025-2037. In the year 2025, the industry size of disaster preparedness systems is evaluated at USD 203.77 billion.

The increasing frequency and severity of natural and human-made disasters have led to the evolution of disaster preparedness systems. The recognition of systemic vulnerabilities exposed by catastrophes drives the demand for robust disaster preparedness systems. For instance, in February 2025, the United Nations Office for Disaster Risk Reduction (UNDRR) released the Kuwait Declaration for Disaster Risk Reduction. The declaration highlights the increasing investments in disaster-resilient infrastructure by leveraging artificial intelligence (AI) and early warning systems. Additionally, the declaration encourages the use of the UN Disaster Loss Accounting System for risk reduction.

Furthermore, the market benefits from global initiatives such as the UNDRR Making Cities Resilient 2030 program that pushes cities to be resilient and sustainable by 2030 and contributes to the achievement of the Sustainable Development Goal 11 (SDG11). The cross-stakeholder initiative bolsters disaster preparedness via advocacy by establishing city-to-city learning networks, connecting multiple layers of government, and building partnerships. The pivot towards anticipatory resilience, supported by advancements in satellite imaging, is poised to redefine how governments and corporations allocate resources.

Disaster Preparedness Systems Sector: Growth Drivers and Challenges

Growth Drivers

- Rising cross-sector collaboration: A major factor influencing the sustained growth of the disaster preparedness systems market is the growth of cross-sector collaboration. Hybrid partnerships between NGOs, tech firms, and governments yield breakthroughs in disaster response times. For instance, the Pacific Disaster Center’s DisasterAWARE platform is leveraged by more than 30 countries. The platform integrates NASA’s Earth Observation data with private-sector AI to simulate disaster impacts to neighborhood-level precision. Moreover, the shift toward an open-source data ecosystem is poised to become the default for mitigating systemic risks.

In February 2025, the Federal Emergency Management Agency (FEMA) released the National Preparedness Report, which highlighted that disasters have become costlier and deadlier. The U.S. has suffered a cumulative cost of over USD 2.6 trillion since 1980 owing to disasters, while the IRA and BIL acts are poised to fund improvements in residential, commercial, and institutional building safety, creating opportunities for key players in the market.

- Surging adoption of AI/ML-driven predictive infrastructure: The integration of AI/ML in disaster preparedness has improved the scope of disaster preparedness systems. For instance, IBM and Google are advancing the use of AI in weather forecasting to reduce the impact of natural disasters. Validated use cases demonstrating improvements in early warning accuracy bolster opportunities in the disaster preparedness systems market. For instance, in January 2025, the National Oceanic and Atmospheric Administration (NOAA) announced the next generation of hurricane modeling and forecasting in the backdrop of improved forecast accuracy during the 2024 Atlantic hurricane season. Opportunities are forecasted to arise from the private sector, supplying advanced forecasting tools to improve disaster preparedness.

- Proliferation of satellite-based earth observation networks: The heightened growth of public and private satellite constellations has enabled hyper-granular disaster monitoring, with platforms such as NASA’s Earth Observing System (EOS) and the European Union’s (EU) Copernicus Emergency Management Service (CEMS) delivering real-time data on wildfires, glacier melt, urban heat islands, etc. Private sector innovations such as the high-resolution Pelican-2 satellite and 36 SuperDoves in January 2025 will help hourly updates of high-risk areas. With more nations leveraging satellite data for disaster planning, opportunities are projected to arise for key players to develop geospatial analytics into disaster preparedness systems.

Challenges

- Overcoming predictive model bias: Advanced disaster preparedness systems are increasingly heavily reliant on AI-driven predictive models, but AI-driven models present bottlenecks as a challenge. For instance, these models are as good as the data they are trained on. Training datasets face challenges of underrepresentation of disasters from developing nations or non-traditional weather patterns, which can lead to forecasting errors. Companies must continuously refine machine learning models with real-time and diverse data to improve prediction accuracy.

- Vulnerability of digital infrastructure: Digital systems that are designed to improve disaster preparedness, such as cloud-based emergency management platforms, AI-powered risk assessment tools, etc., are vulnerable to disasters. Hurricanes, cyberattacks, earthquakes, etc., can disrupt sensor networks and critical communication links, creating blind spots for response teams. To navigate the challenge, companies must invest in decentralized infrastructure and offline-capable systems to prevent failures in disaster scenarios.

Disaster Preparedness Systems Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.5% |

|

Base Year Market Size (2024) |

USD 190.8 billion |

|

Forecast Year Market Size (2037) |

USD 551.02 billion |

|

Regional Scope |

|

Disaster Preparedness Systems Segmentation

Solution (Disaster Recovery Solutions, Geospatial Solutions, Situational Awareness Solutions)

Disaster recovery solution segment is anticipated to hold over 44.5% disaster preparedness systems market share by the end of 2037. The segment’s growth is characterized by the rising demand for data protection and business continuity strategies. With organizations globally reliant on digital infrastructures, the demand to safeguard critical data from disasters has intensified. Furthermore, the increase in cyberattacks has added to the adoption of disaster recovery solutions. For instance, the National University of California reported that the global cybersecurity workforce reached 4.7 million in the backdrop of cloud-conscious cases increasing by 110% in 2024.

Moreover, in December 2024, the Center for Strategic and International Studies highlighted that cyberattacks on government entities in India had surged by 138% between 2019 and 2023. Additional facets of the segment’s growth are cyber resilience guidelines that have catalyzed demands from cyber-physical recovery solutions with generative AI being embedded in disaster recovery as a service solution.

Type (Surveillance System, Emergency/Mass Notification System, Safety Management System, Earthquake/Seismic Warning System, Disaster Recovery and Backup Systems, Others)

By 2037, surveillance system segment is projected to account for around 36.6% disaster preparedness systems market share, attributed to the early threat detection capabilities offered by these systems. The shift towards autonomous surveillance grids that can process data locally to reduce latency during crisis benefits growth. In March 2022, the UN announced a project with the World Meteorological Organization aiming to provide early weather-warning system access to every person on the planet within five years of the project’s commencement to mitigate the adverse impacts of frequent natural disasters.

The opportunities are rife for private sector players to develop and position advanced surveillance systems in disaster-prone areas. For instance, surveillance systems to monitor rising water levels and structural weaknesses of levees and dams in flood-prone areas can bolster adoption rates. In August 2024, the Government of India launched the FloodWatch India 2.0 flood alert app to provide real-time updates from 592 monitoring stations.

Communication Technology (Emergency Response Radars, First Responder Tools, Satellite Phones, Others)

In disaster preparedness systems market, emergency response radars segment is set to account for around 30.2% revenue share by 2037. The growing incidences of climate-related disasters have underscored the necessity for advanced radar systems capable of providing real-time data to emergency responders. For instance, during the 2024 Rio Grande Valley floods, SpaceX’s Starlink was used to integrate direct-to-cell satellite technology enabling smartphones to connect with LEO satellites without ground infrastructure. Opportunities are rife for private entities to supply cognitive radio systems for disaster response task forces to utilize in congested crisis zones.

Our in-depth analysis of the global market includes the following segments:

|

Solution |

|

|

Type |

|

|

Communication Technology |

|

|

Services |

|

|

End use |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportDisaster Preparedness Systems Industry - Regional Scope

North America Market Forecast

North America disaster preparedness systems market is set to dominate revenue share of around 34.6% by the end of 2037. The rising threats of natural disasters and cyberattacks in the region have led to robust growth. The region’s well-established market players and strong public sector support for disaster management initiatives contribute to the sustained expansion. Furthermore, North America is prone to natural disasters such as hurricanes with the frequencies increasing over the years, which creates sustained demand for monitoring and forecasting systems.

The U.S. disaster preparedness systems market is expected to account for the largest revenue share in North America. The surging cases of natural and man-made disasters in the U.S. have spurred sustained demand for disaster preparedness systems. Moreover, the U.S. market is characterized by comprehensive policy frameworks aimed at improving national resilience. The U.S. Global Change Research Program has reported that the frequency and intensity of North Atlantic hurricanes have increased since the early 1980s. In January 2025, the California wildfires caused substantial damage highlighting the need for robust disaster preparedness systems. The proliferation of predictive disaster forecasts powered by AI and the rising opportunities for resilience-as-a-service (RaaS) platforms are poised to drive stable growth of the market by the end of 2037.

The Canada market is forecasted to expand during the stipulated timeline of market analysis. Initiatives to improve early warning capabilities and community engagement have bolstered the Canada market. In August 2024, the Canadian Earthquake Early Warning system was launched by Natural Resources Canada (NRCan) exemplifying the country’s commitment to leverage technology for disaster mitigation. Furthermore, floods are the most common hazards in Canada and opportunities arise in the development of advanced monitoring solutions to mitigate flood-related losses.

Asia Pacific Market Forecast:

APAC disaster preparedness systems market is positioned to hold the second-largest revenue share by the end of 2037, attributed to rising cyberattacks and the heightened vulnerability to natural disasters, with governments investing in proactive initiatives for disaster preparedness. The proliferation of advanced early warning systems and emergency response infrastructure has benefitted the key players with a strong presence in APAC. The ASEAN Agreement on Disaster Management and Emergency Response (AADMER) has enabled the shared deployment of satellite-based flood monitoring tools, while the interoperable crisis communication protocols have improved coordination across economies.

The China disaster preparedness systems market is projected to expand during the stipulated timeframe. The market’s growth is underpinned by significant government investments and strategic policy reforms. The fourteenth five-year plan of the government from 2021 to 2025 emphasized the modernization of emergency management systems, focusing on improving disaster prevention and response. Moreover, military-grade BeiDou satellite networks are repurposed for civilian disaster coordination to enable sub-meter precision in landslide monitoring across the Yangtze River basin. Opportunities are rife in the advancements of blockchain-secured supply chain platforms by private players to negate disruptions of medical logistics during a crisis.

The India market is set for robust expansion during the forecast period. Flash floods, earthquakes, landslides, etc., are major concerns in India. In October 2024, the World Economic Forum (WEF) reported that the government had committed USD 300 million to mitigate city flooding. With flash floods in urban areas becoming a major cause of concern in the country, the market is poised to provide sustained opportunities to supply advanced monitoring systems to check flood levels and early warning systems to reduce losses. Moreover, the heightened demand for the adoption of state-of-the-art technology to support community-based disaster management programs is estimated to assist the market’s continued growth.

Companies Dominating the Disaster Preparedness Systems Landscape

- Lockheed Martin

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Thales Group

- Siemens

- Microsoft

- Honeywell International Inc.

- OnSolve

- Specialty Program Group LLC

- Planet Labs

The disaster preparedness systems market is projected to expand during the forecast period. Leading companies in the sector are integrating AI and IoT solutions to offer real-time alerts and predictive analytics. Additionally, they are actively pursuing mergers and acquisitions to broaden product offerings and improve presence in new emerging markets. By aligning services with regulatory requirements, the companies are positioning themselves as vital partners in disaster risk management.

Here are some key players in the market:

In the News

- In January 2025, Disaster Recovery Services, a part of the Specialty Program Group LLC announced that it had rebranded to Delivering Results & Solutions (DRS). The company has expanded its services in disaster preparedness and response to include claims construction project management to improve the scope of solutions.

- In June 2024, N-able Inc., announced the expansion of its disaster recovery flexibility by introducing Standby Image to VMware ESXi. The Standby Image recovery feature includes support for Microsoft Azure and Hyper-V.

Author Credits: Abhishek Verma

- Report ID: 7298

- Published Date: Mar 05, 2025

- Report Format: PDF, PPT