Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Genetically Modified Feed Market size was USD 100.74 billion in 2024 and is estimated to reach USD 202.06 billion by the end of 2037, expanding at a CAGR of 5.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of genetically modified feed is assessed at USD 106.28 billion.

The global genetically modified feed market is anticipated to grow, owing to the surging demand for nutrient-rich food, resulting in increased global feed production. The International Feed Industry Federation revealed that an estimated USD 400 billion is made annually by the production of commercial feed worldwide. Millions of people worldwide rely heavily on the production of livestock and the consumption of animal products for their nutritional and economic well-being. The greatest and most crucial element in guaranteeing safe, plentiful, and reasonably priced animal proteins is animal feed, which plays a major role in the global food economy.

Furthermore, the importance of gut health for animal performance and well-being is becoming more well-acknowledged. Nowadays, feed strategies have a strong emphasis on promoting the gut microbiota, which is essential for immunity, disease resistance, and nutrient absorption. Demand for probiotics, prebiotics, and postbiotics, as well as novel feed formulations that lessen gastrointestinal stress has increased as a result of this focus. Beyond the advantages of short-chain fatty acids, celobiotics may have an impact on gut health. This idea is relatively new, and its potential impact on food animals should be investigated.

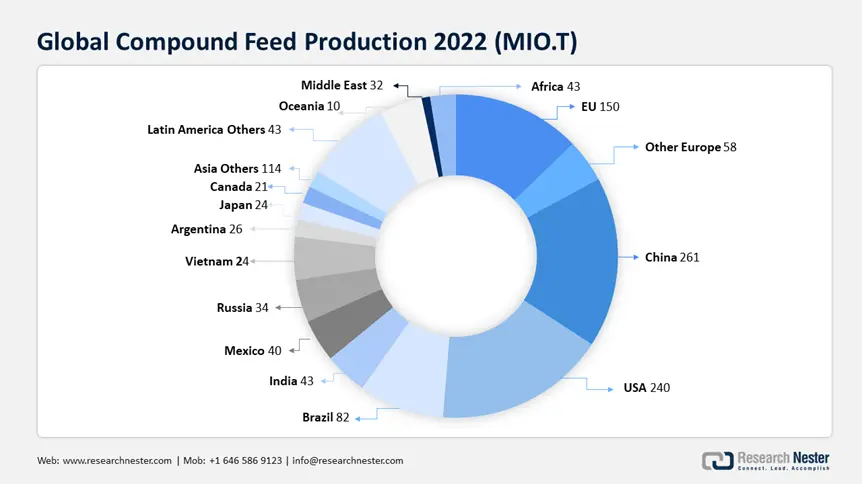

The table below shows the global animal feed production in 2022 (in million tons):

Genetically Modified Feed Market: Growth Drivers and Challenges

Growth Drivers

- Increasing production of genetically modified crops: As the biotechnology sector and its related industries have progressed, global food consumption patterns have undergone significant transformations. There is a growing trend towards multi-nutrient-based food products. Advances in genetically modified crops have enabled the production of food items that confer various benefits to consumers. For instance, genetically modified corn and soybeans provide distinct advantages not found in their conventional counterparts, resulting in increased demand. Between 1996 and 2019, GM crop production expanded from 1.7 to 190.4 million hectares worldwide, a roughly 112-fold increase.

Moreover, numerous companies are actively engaged in the research and development of genetically modified crops that possess enhanced nutritional value to appeal to a broader consumer base. Consequently, the genetically modified feed market is projected to expand in response to the surging demand for GM feed attributable to its additional nutritional advantages.

- Integration of advanced technologies: The fields of animal nutrition and feed management are undergoing a significant transformation through the adoption of digital technologies. The precise monitoring of feed intake, animal growth, and health indicators is facilitated by the implementation of Internet of Things (IoT) devices, sensors, and artificial intelligence (AI). The application of big data analytics enables the prediction of disease outbreaks, the enhancement of productivity, and the optimization of feeding strategies. In response to consumer demands regarding food safety and ethical sourcing, blockchain technology is increasingly utilized to improve traceability and transparency within the feed supply chain. Furthermore, advanced formulation technologies that leverage data related to ingredients, their origins, and application rates are gaining importance in ensuring accurate feed formulations while assessing their environmental impact.

The integration of AI in genetic engineering has significantly expanded due to its ability to yield precise outcomes and enhance related processing methods. Recently, AI has been incorporated into genetic engineering practices to achieve improved results, particularly in the development of protein-based crops. Consequently, it is anticipated that the growing application of AI technology in bioinformatics research will provide substantial growth opportunities for stakeholders in the genetically modified feed market.

Challenges

- Concerns regarding health: Targeted features including herbicide tolerance, insect resistance, nitrogen-fixing, and virus resistance are introduced using methods like haploid induction and gene stacking. These characteristics are meant to tackle issues in agriculture such as pests, droughts, and illnesses. Notwithstanding the advantages, GM foods have generated debates and public anxiety owing to possible hazards such as toxicity, environmental impacts, intellectual property, and allergies. Given the possible health concerns associated with inserted genes, gene expression, secondary effects, and pleiotropic effects, food safety is a major problem. People with cysteine or methionine intolerances are concerned about allergenic reactions, especially from bean plants. Additionally, GM foods have been connected to health issues such as allergies, gastrointestinal distress, and cancer.

- Utilization of pesticides and other toxic substances: However genetically modified foods, like rice that is resistant to disease and tobacco that is resistant to viruses, may be able to address these problems and lessen the need for pesticides. Products that are innovative Beverages, food processing, and a variety of foods, including rice, bananas, sweet potatoes, and human immunizations against infectious diseases like hepatitis B, are all included in the GM food industry. Additionally, GM foods can be used to meet the demand for biofuel and animal feed. Utilizing genome editing and ASL gene technology, gene stacking, and CRISPR technologies are being used to create new polymers and enhance food security.

Genetically Modified Feed Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.5% |

|

Base Year Market Size (2024) |

USD 100.74 billion |

|

Forecast Year Market Size (2037) |

USD 202.06 billion |

|

Regional Scope |

|

Genetically Modified Feed Segmentation

Source (Crops, Fruits & Vegetables)

In genetically modified feed market, crops segment is set to capture revenue share of over 82.3% by 2037. The widespread use of genetically modified crops, such as corn and soybeans, is the primary driver of the crop by source segment's market domination. These crops are extremely successful and economical for producing feed since they are genetically modified to have qualities such as resistance to pests and herbicides as well as enhanced nutritional value. Because of their high protein and calorie content—both of which are critical for animal growth and productivity—corn and soybeans are used as the main ingredients in feed. These GM crops' extensive production, accessibility, and well-established supply networks further cement their market domination and satisfy the growing need for wholesome, sustainable animal feed on a global scale.

Feed Type (Roughages, Concentrates)

The concentrates segment in genetically modified feed market is poised to garner a significant share during the assessed period. Because of their superior nutritional value and targeted formulation—both of which are critical for maximizing livestock growth and productivity—concentrates dominate the animal feed alternative protein market by feed type segment. The high-energy and high-protein components of concentrates are intended to supplement forages and other basic diets, giving animals a well-rounded diet that supports their growth phases and production objectives. Their ability to promote feed efficiency, improve weight gain, and boost overall animal health makes concentrates a favorite choice among farmers and producers. Concentrates' dominance in the market is also fueled by the rising demand for premium meat, dairy, and poultry products.

Our in-depth analysis of the global genetically modified feed market includes the following segments:

|

Source |

|

|

Form |

|

|

Feed Type |

|

|

Livestock |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportGenetically Modified Feed Industry - Regional Synopsis

North American Market Statistics

North America genetically modified feed market is estimated to capture revenue share of over 30.6% by 2037. With its sophisticated agricultural infrastructure, strong emphasis on sustainability, and significant investment in research and development, North America leads the market for animal feed alternative proteins. The area gains from a thriving livestock sector and rising consumer demand for protein from sustainable sources. Due to supportive regulations and cutting-edge protein production methods, the U.S. and Canada are leaders in the adoption of alternative proteins. Market expansion is further accelerated by the existence of important industry participants and partnerships between private businesses and academic organizations. A strong supply chain and growing knowledge of the advantages alternative proteins provide for the environment support this dominance.

Furthermore, with the majority of corn and soybeans in the U.S. being genetically modified, GM feed has become a crucial component in the agricultural industry. Farmers and livestock producers favor GM feed due to its benefits, such as higher nutrient content, improved digestibility, and resistance to pests and diseases. Additionally, advancements in biotechnology and supportive government regulations have contributed to the genetically modified feed market’s growth. As consumer demand for meat, dairy, and poultry products continues to rise, the GM feed industry is expected to see further expansion in the coming years.

The U.S. Department of Agriculture revealed that in 1996, genetically engineered (GE) seeds for key field crops were commercially launched in the United States, and subsequent years saw an increase in adoption rates. Nowadays, GE cultivars are used to produce more than 90% of the maize, upland cotton, and soybeans grown in the U.S.

Furthermore, the Government of Canada has provided clear guidelines on GM feed regulations, encouraging innovation and investment in the sector. For almost two decades, Health Canada has been evaluating genetically modified foods. In Canada, more than 140 genetically modified (GM) foods were currently allowed for sale as of 2019. Additionally, the country’s strong livestock industry, particularly in beef, dairy, and poultry is driving demand for efficient and sustainable feed solutions.

APAC Market Analysis

Asia Pacific genetically modified feed market is expected to grow at a significant rate during the projected period. The market has grown as a result of the rising demand for dairy products and broiler chicken. Growing interest in genetically modified maize, bananas, tomatoes, and brinjal in countries like India, Japan, China, Singapore, Australia, and Thailand, as well as increased investments made by new startup businesses to create genetically modified crops, is also propelling the market's expansion. Additionally, governments in several nations, including China, Japan, India, and others, have emphasized creating genetically modified crops with extra nutritional value, which propels market expansion. For instance, the Indian government pushed several biotech research institutes to create genetically modified seeds with enhanced production and quality for 13 key crops, such as rice, wheat, and sugarcane, in December 2022.

India’s genetically modified feed market is experiencing gradual growth, influenced by policy adjustments and industry demands. In August 2021, the Government of India loosened import regulations to allow the first shipments of 1.2 million tons of genetically modified soymeal to support the country's poultry industry, which was suffering from a spike in animal feed prices that tripled in a single year to a record high. Similarly, the government order allowed an additional 550,000 tons of GM soymeal to be imported into the country in 2022. Also, experts have discussed the benefits of GM crops in aquaculture, highlighting their role in improving feed quality and sustainability.

China’s genetically modified feed market is expanding rapidly, driven by policy support, rising demand for high-yield crops, and a push for agricultural self-sufficiency. In recent years the government has eased restrictions on GM crop cultivation, approving GM corn and soybean varieties for commercial planting to reduce dependence on imports. Additionally, nation’s growing livestock industry, especially in pork and poultry production, is fueling demand for high-protein feed, further driving demand for high-protein feed. The National Bureau of Statistics China reports that 57.94 million tons of pork were produced in 2023. Reduced producer margins resulting in higher culling rates and increased slaughter, with a reported surplus on the domestic market, are the main causes of this 5% annual increase. The Agriculture and Horticulture Development Board (AHDB) revealed that the government is actively promoting the shift from small-scale to large-scale agriculture, steadfastly adhering to its 2020 pork self-sufficiency target of 95%.

The table below indicates the imports of pig meat in China in 2023:

|

Country |

Import Share of Pig Meat |

|

Brazil |

26% |

|

Spain |

25% |

|

Canada |

9% |

|

USA |

8% |

|

Netherlands |

8% |

Source: Trade Data Monitor LLC

Companies Dominating the Genetically Modified Feed Market

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- DuPont de Nemours, Inc.

- Bayer AG

- Syngenta

- Vivici B.V.

- Corteva, Inc.

- The J.R. Simplot Company

- Okanagan Specialty Fruits Inc.

- Agritope Inc.

To improve the nutritional value and safety of their goods, major players in the genetically modified feed market industry are constantly investing in research and development. Leading companies in the genetically modified feed market are concentrating on strategic alliances and acquisitions to broaden their customer base and line of products. It is anticipated that the competitive environment will continue to be dynamic, with new players and cutting-edge technologies influencing the growth of the genetically modified feed market.

In the News

- In March 2025, Vivici, a Dutch ingredients firm, introduced Vivitein BLG to the US market. Vivitein BLG, the flagship ingredient of its Vivitein protein platform, is now accessible, allowing B2B clients to deliver revolutionary and distinctive goods to consumers in the U.S.

- In October 2023, Syngenta Seedcare announced the opening of its first biologicals service center at The Seedcare Institute in Maintal, Germany, as part of its strategy to deepen its focus on biologicals and expand its leadership in seed treatment.

Author Credits: Parul Atri

- Report ID: 7394

- Published Date: Mar 28, 2025

- Report Format: PDF, PPT