Global Market Size, Forecast, and Trend Highlights Over 2025-2037

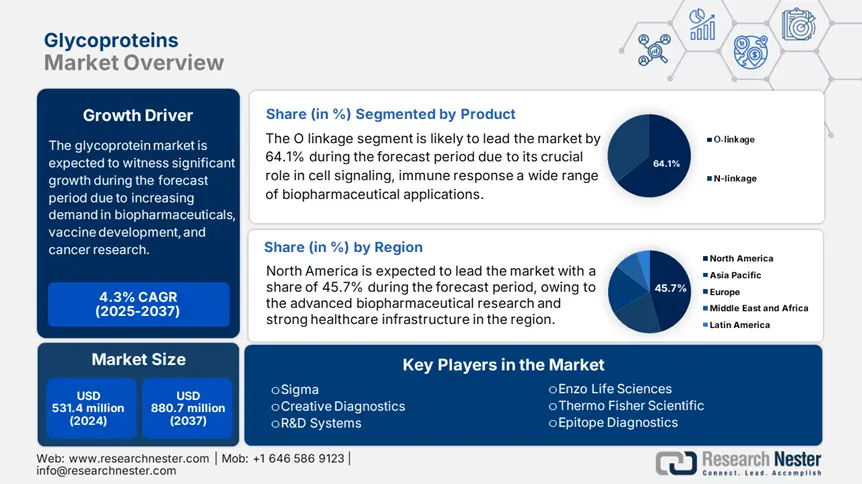

Glycoproteins Market size was estimated at over USD 531.4 million in 2024 and is poised to reach USD 880.7 million by the end of 2037, expanding at a CAGR of 4.3% during the forecast timeline, i.e., 2025-2037. In 2025, the industry size of glycoproteins is assessed at USD 554.2 million.

The rising prevalence of cancer, autoimmune diseases, and neurological and infectious disorders inflates the demand for glycoproteins due to the proven efficacy of the therapeutics. In addition, the glycoproteins market is poised for significant growth driven by its crucial role in biopharmaceuticals and vaccine development. Furthermore, they are extensively used in therapeutics, diagnostics, and drug delivery systems due to their structural and functional importance in cellular processes. Increasing awareness of the efficiency of glycoproteins among healthcare professionals and consumers is further fueling the market expansion during the forecast timeline.

Glycoproteins are used as biomarkers in diagnosing and monitoring cancer-influencing processes such as cell signaling, invasion, and metastasis. According to the February 2025 WHO report, carcinoma is a leading cause of death globally, accounting for nearly 10 million deaths in 2020, or nearly one in six deaths. It further stated that cancers can be cured if detected early and treated effectively. Thus, growing mortality cases are concerning the public healthcare associations, pushing them to invest in availing effective treatments, thereby necessitating the requirement of glycoproteins for better patient outcomes.

New Cancer Cases

|

Rank |

Cancer Type |

New Cases in 2020 |

|

1 |

Breast cancer |

2.26 million |

|

2 |

Lung cancer |

2.21 million |

|

3 |

Colon and rectum cancer |

1.9 million |

|

4 |

Prostate cancer |

1.4 million |

|

5 |

Skin (non-melanoma) cancer |

1.2 million |

|

6 |

Stomach cancer |

1.0 million |

Source: WHO, February 2025

Glycoproteins Sector: Growth Drivers and Challenges

Growth Drivers

- Wide range of applications: The proven effectiveness of the products from the glycoproteins makes them preferable for broader healthcare applications. This efficacy encourages biopharmaceutical firms to undergo extensive research to explore its potential. For instance, in October 2020, the Native Antigen Company launched ten monoclonal antibodies targeting SARS-CoV-2. These antibodies recognize different epitopes of the SARS-COV-2 Spike glycoproteins, aiding research in diagnostics, therapeutics, and vaccines. This highlights the critical role of glycoproteins and the exploration of their potential in the industry.

- Advancements in research activities: Advancements in analytical technologies, such as mass spectrometry and glycoengineering techniques, allow for better production of therapeutic glycoproteins. According to a study by Biotechnology Advances in March 2025, bacterial glycoproteins engineering has grown rapidly over the past few years due to its influential properties. Besides, over 40% of approved drugs in the current recombinant therapeutics market feature glycosylated proteins. This rise is revolutionizing glycoproteins synthesis and overcoming mammalian expression limitations. Such advancements will enable the affordable and scalable production of glycoproteins therapeutics.

Challenges

- Complexity in production: One of the major restraints in the glycoproteins market is the complexity and cost associated with their production. This can create an economic barrier among patients from price-sensitive regions. Furthermore, this may limit the expansion of this sector as glycoproteins are often produced through complex processes such as recombinant DNA technology or mammalian cell culture systems, which require specialized equipment, skilled labor, and extensive quality measures, resulting in high production costs. This makes it difficult for manufacturers to afford them, restricting product exposure across the healthcare industry.

- Regulatory hurdles: Despite having huge demand, growth in the glycoproteins market can be hindered due to regulatory hurdles. As glycoproteins are widely used in therapeutic applications, the regulatory frameworks insist on the extended process to analyze their efficacy, limiting market penetration. Additionally, the variability in glycosylation patterns between batches can pose a hurdle for this sector to captivate the optimum consumer base in the glycoproteins industry.

Glycoproteins Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

4.3% |

|

Base Year Market Size (2024) |

USD 531.4 million |

|

Forecast Year Market Size (2037) |

USD 880.7 million |

|

Regional Scope |

|

Glycoproteins Segmentation

Product Type (O-linkage, N-linkage)

O-linkage segment is expected to account for glycoproteins market share of around 64.1% by 2037. It plays a critical role in the structural and functional diversity of glycoproteins. In January 2025, UK Biobank announced the launch of the world’s most comprehensive protein study, analyzing up to 5,400 proteins in 600,000 samples to advance disease research. The study was supported by 14 biopharmaceutical companies aiming to revolutionize drug discovery. Therefore, such innovations are anticipated to enhance glycoproteins research by detecting disease-linked protein changes, accelerating biomarker discovery, and developing glycoproteins-based therapeutics.

Application (Hospital, Research Institutes)

In terms of application, the hospital segment is projected to garner a significant share in the glycoproteins market during the forecast period. This segment is pledged with the growing need for advanced glycoproteins to cure medical conditions. For instance, in October 2023, the Medical University of Vienna announced that the researchers at the university discovered that dormant tumor cells surviving chemotherapy can be targeted through the inhibition of a specific protein called P-glycoproteins (P-gp). Thus, such discoveries are anticipated to showcase efficacy and demand, thus driving growth in the market.

Our in-depth analysis of the global glycoproteins market includes the following segments:

|

Product Type |

|

|

Application |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportGlycoproteins Industry - Regional Synopsis

North America Market Analysis

North America in glycoproteins market is predicted to hold more than 45.7% revenue share by 2037. Advancements in biopharmaceutical research and increased demand for glycoproteins-based drugs in precision medicine are the major growth factors in this landscape. According to research published by the CDC in October 2024, 702,880 deaths took place from heart illness in 2022. The report further stated that one person dies every 33 seconds from cardiovascular disease, which is a major cause of death in the region. This highlights the growing need for advanced drugs, such as glycoproteins, in this region.

The U.S. has become the hub for global leaders in the glycoproteins market due to its wide consumer base and excellent research and development activities. The country presents a great opportunity for them to expand their business, making a crucial step in globalization. The growing regulatory emphasis and partnerships strengthen the competitive landscape. In November 2023, Gum Products International Inc. announced the acquisition of International Protein Colloids, Inc., enhancing its product portfolio. Therefore, the market is anticipated to witness steady growth with a great emphasis on protein-based food ingredients.

Canada is steadily consolidating its position in the glycoproteins market with the demand for glycoproteins in vaccine production, immunotherapy, and biomedical research. Additionally, the proactive government initiatives and regulatory approvals further inspire other domestic participants to establish their footprint in this country. In February 2022, GSK plc and Medicago Inc. announced the approval of COVIFENZ, an adjuvanted plant-based COVID-19 vaccine that uses CoVLP technology with the vaccine of recombinant spike (S) glycoproteins. This is further inflating demand in this sector due to the proven efficacy of glycoproteins therapeutics in treating disorders.

APAC Market Statistics

Asia Pacific is expected to demonstrate the fastest growth in the glycoproteins market with its strong captivity in biotechnology and research on biologics. The region is augmenting such growth with the developmental tendency of countries such as China, India, Japan, and Australia. The governing bodies in these countries are inspiring domestic companies to expand their production and supply across the world to take leadership in this sector. Thus, the growth in this region is further carried forward with the efforts of regional pharma leaders who are researching to bring innovations in this field.

China's glycoproteins market is expanding at a rapid pace, and it is emerging as a great developing source. The country is also aiming to develop glycoproteins-based therapies for oncology, autoimmune disorders, and metabolic disorders, leveraging advancements in glycoengineering. In December 2024, GSK plc announced that it had entered into an agreement with Chongqing Zhifei Biological Products, Ltd. to revise the terms on which Zhifei would commercialize GSK’s shingles vaccine, Shingrix, in China. It further stated to extend the original 3-year period (2024-2026) during which Zhifei has exclusive rights to import, distribute, and co-promote the vaccine in the country, thereby contributing to market progression.

Australia is propagating the regional glycoproteins market with its strong emphasis on biosimilars and rising demand for glycoproteins in various applications. The country’s thriving pharmaceutical industry, coupled with increased investments, is facilitating growth in this sector. For instance, in March 2022, Vaxxas announced that it had licensed the HexaPro Spike glycoproteins from the University of Texas for use in needle-free vaccine patches. HexaPro, a second-generation SARS-CoV-2 spike protein, is designed to be highly stable and immunogenic. The move reflects the expanding applications of glycoproteins and constitutes in enhancing accessibility.

Companies Dominating the Glycoproteins Landscape

- Sigma

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Creative Diagnostics

- R&D Systems

- Enzo Life Sciences

- Thermo Fisher Scientific

- Chongqing Zhifei Biological Products, Ltd.

- Epitope Diagnostics

- Creative Biolabs

- Ventus Therapeutics

- GSK plc

- Bio-Techne

- Venn Biosciences Corporation

- BD Biosciences

- Bristol Myers Squibb

- Shanghai Korain Biotech Co.

- CSL Behring K.K.

- Ginkgo Bioworks Holdings, Inc

The competitive demographic of the glycoproteins market is inspiring global leaders to enforce their financial and academic resources in innovating more effective solutions. They are continuously putting efforts to promote adoption to push their territory forward for globalization. In January 2025, Bio-Techne announced the launch of AI-generated designer proteins to enhance cell therapy and regenerative medicine. The expanded portfolio includes next-generation recombinant proteins optimized for receptor affinity and heat stability. This is further enhancing glycoproteins-based therapeutics with increased stability in biopharmaceutical production.

Some of the key players in the market include:

In the News

- In October 2024, the InterVenn Biosciences GlycoVision platform was featured in an ESMO 2024 oral presentation. The novel serum glycoproteomic biomarkers predict response to nivolumab + cabozantinib versus sunitinib in advanced RCC.

- In July 2024, Ventus Therapeutics announced the expansion with the opening of a new laboratory and office facility in Montreal, Canada. This 24,000-square-foot state-of-the-art facility will strategically expand its research and development capacity, enabling continued growth.

- In May 2023, GSK plc announced the approval of its Arexvy, which is the world’s first respiratory syncytial virus (RSV) vaccine for older adults used in the prevention of lower respiratory tract disease (LRTD) caused by respiratory syncytial virus (RSV).

Author Credits: Rajrani Baghel

- Report ID: 7460

- Published Date: Apr 04, 2025

- Report Format: PDF, PPT