Global Market Size, Forecast, and Trend Highlights Over 2025-2037

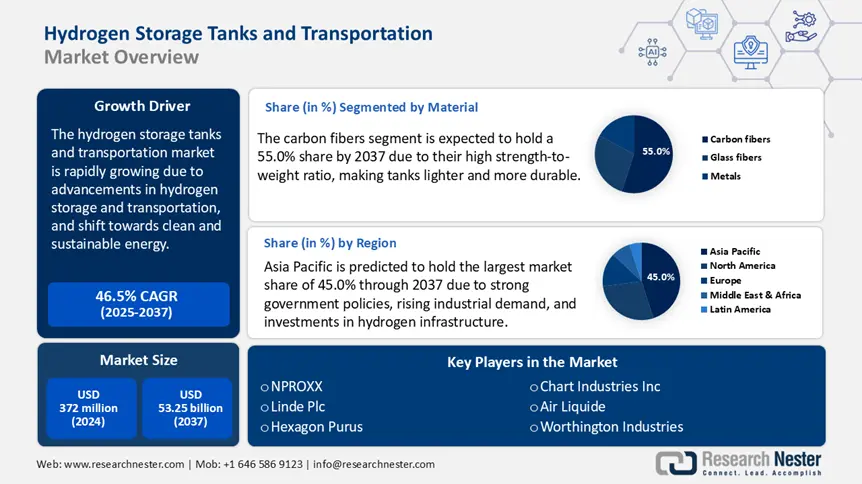

Hydrogen Storage Tanks and Transportation Market size was valued at USD 372 million in 2024 and is projected to reach USD 53.25 billion by the end of 2037, rising at a CAGR of 46.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of hydrogen storage tanks and transportation is evaluated at USD 544.9 million.

The hydrogen storage tanks and transportation market is expanding due to the global shift towards clean and sustainable energy. One of the most important growth drivers is the increasing demand for hydrogen as a sustainable fuel alternative in the industrial and transportation sectors. As governments implement stringent carbon reduction policies and corporations seek low-emission energy sources, the need for efficient hydrogen storage and transport infrastructure is growing. This shift is accelerating technological advancements in high-pressure, liquid hydrogen storage and pipeline transport, positioning hydrogen as a key component in the transition to a low-carbon economy.

The increasing emphasis on hydrogen as a sustainable fuel alternative is also driven by initiatives and investments by governments and industries across the globe to meet decarbonization goals. A recent example is the Port of Houston Authority’s initiative to develop a hydrogen refueling station in Bayport, Texas. For instance, in January 2025, the authority received a USD 25 million grant from the U.S. Department of Transportation and Federal Highway Administration to support this project. The station aims to provide pipeline-based fueling options for trucks, enhancing supply chain growth across Texas and the Gulf Coast. This public-private collaboration with Linde PLC, overseeing design, construction, and operation, reflects a significant commitment to expanding hydrogen infrastructure to meet decarbonization goals.

Hydrogen Storage Tanks and Transportation Sector: Growth Drivers and Challenges

Growth Drivers

- Technological advancements in hydrogen storage and transportation: Continuous innovations in material science and engineering have led to the development of advanced hydrogen storage tanks and transportation methods. For instance, the use of carbon fiber reinforced materials enhances the strength-to-weight ratio of storage tanks, improving efficiency and safety. Additionally, advancements in hydrogen liquefaction technologies enable more efficient and cost-effective storage and transport, facilitating broader adoption across various sectors.

- Government policies and regulatory support: The curated financial incentives, emissions reduction targets, and clean energy mandates are driving the expansion of hydrogen storage and transportation infrastructure. For instance, the Inflation Reduction Act (IRA) in the U.S. provides tax credits of up to USD 3 per kilogram for clean hydrogen production, incentivizing its use in transportation and industrial applications. Additionally, the Fit for 55 initiative by the European Union mandates a reduction of greenhouse gas emissions by 55% by 2030. These government initiatives create a favorable regulatory environment for hydrogen adoption.

- Rising demand in heavy industry and transportation sectors: Hydrogen is increasingly being adopted as a cleaner alternative in sectors that are challenging to decarbonize, such as heavy industry and transportation. The development of hydrogen refueling infrastructure and the integration of hydrogen in industrial processes are expanding the need for efficient storage and transportation solutions. For instance, in February 2025, Norwegian shipping firm Hoegh Evi developed hydrogen shipping routes to Germany, enhancing the need for large-scale hydrogen storage tanks and transport. Thus, the rising demand in heavy industries, rail, maritime, and aviation is supporting the growth of hydrogen storage and transportation infrastructure.

Challenges

- High costs of storage and transport infrastructure: Hydrogen storage and transportation are expensive due to the need for advanced materials and specialized infrastructure. Hydrogen must be stored in high-pressure tanks, i.e., 350-700 bar, or cryogenic tanks that require costly materials and engineering. Transportation of hydrogen via dedicated hydrogen pipelines is expensive to build and challenging to retrofit from existing natural gas networks. Thus, developing cost-effective materials and efficient storage solutions is critical for scaling hydrogen adoption.

- Safety and leakage risks: Hydrogen’s properties pose significant safety challenges in storage and transportation. Hydrogen molecules are extremely small and can escape through traditional storage materials, increasing the risk of fire or explosions. Also, keeping hydrogen in liquid form requires extremely low temperatures, leading to boil-off losses as some hydrogen evaporates over time. Thus, innovations in leak-proof storage materials and enhanced safety measures are needed to address these risks.

Hydrogen Storage Tanks and Transportation Market: Key Insights

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

46.5% |

|

Base Year Market Size (2024) |

USD 372 million |

|

Forecast Year Market Size (2037) |

USD 53.25 billion |

|

Regional Scope |

|

Hydrogen Storage Tanks and Transportation Segmentation

Material (Carbon Fibers, Glass Fibers, Metals)

Carbon fibers segment is expected to account for hydrogen storage tanks and transportation market share of more than 55% by the end of 2037, due to their high strength-to-weight ratio, making tanks lighter and more durable. The use of carbon fibers assures high-pressure hydrogen storage, i.e., 350-700 bar, while being leak resistant and maintaining structural integrity. For instance, to meet the escalating demand for carbon fiber in hydrogen storage tanks, Hyosung in August 2024 invested 46.9 billion to expand its annual carbon fiber production capacity to 24,000 tonnes by 2028.

Pressure (200 - 500 bar, Below 200 bar, Above 500 bar)

The 200-500 bar segment is anticipated to register substantial market growth through 2037 due to increasing demand for efficient and high-capacity storage solutions in transportation and industrial applications. This pressure range allows safe and compact storage that makes hydrogen more viable for fuel cell vehicles, heavy-duty transport, and refueling infrastructure. Advances in carbon fiber-reinforced tanks enhance durability while reducing weight and costs. As governments push for hydrogen adoption, the need for high-pressure storage systems continues to rise.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Pressure |

|

Want to customize this research report as per your requirements? Our research team will cover the information you require to help you take effective business decisions.

Customize this ReportHydrogen Storage Tanks and Transportation Industry - Regional Scope

Asia Pacific Market Analysis

Asia Pacific in hydrogen storage tanks and transportation market is predicted to hold over 45% revenue share by the end of 2037, due to strong government policies, rising industrial demand, and investments in hydrogen infrastructure. China, Japan, and South Korea are the leading adopters of fuel cell vehicles, hydrogen refueling stations, and large-scale storage projects. Advances in high-pressure and liquefied hydrogen tanks are improving efficiency and safety.

The market is rapidly expanding in China due to strong government support, expanding fuel cell vehicle adoption, and investments in hydrogen infrastructure. According to the National Development and Reform Commission, the country aims to have 50,000 FCVs and 1000 hydrogen refueling stations by 2025, driving demand for high-pressure storage tanks. Companies in China are developing advanced carbon fiber reinforced tanks to improve efficiency and reduce costs.

The hydrogen storage tanks and transportation market in South Korea is rising due to aggressive government policies, strong industrial backing, and advancements in hydrogen mobility. The country’s hydrogen economy roadmap aims to deploy 6.2 million fuel cells and 1200 hydrogen refueling stations by 2040, driving demand for high-pressure tanks. Companies such as Hyosung and Hanwha Cimarron are investing in carbon fiber reinforced tanks for safer and more efficient hydrogen storage. With a focus on green hydrogen production and export infrastructure, South Korea is positioning itself as a global leader in hydrogen logistics.

North America Market Analysis

North America hydrogen storage tanks and transportation market is anticipated to hold a significant share from 2025 to 2037, owing to strong federal funding, clean energy mandates, and expanding hydrogen mobility projects. Top countries in the region are investing in regional hydrogen hubs and refueling networks to support heavy-duty transport and industrial decarbonization. With an increasing focus on sustainability, hydrogen as an alternative fuel is gaining traction, leading to better hydrogen storage tanks and transportation facilities.

The market in the U.S. is growing due to federal clean energy initiatives, expanding hydrogen hubs, and rising demand for heavy-duty transport solutions. For instance, in October 2023, the U.S. Department of Energy invested USD 7 billion across seven Regional Clean Hydrogen Hubs, aiming to produce three million metric tons of hydrogen annually, reducing carbon dioxide emissions by 25 million metric tons when fully operational. The initiative focuses on lowering clean hydrogen production costs to USD 1 per kilogram by 2030, enhancing its competitiveness with conventional hydrogen.

The hydrogen storage tanks and transportation market in Canada is expanding owing to the country’s vast renewable energy resources, government-backed hydrogen strategy, and increasing export potential. Canada is developing large-scale hydrogen storage projects to support domestic use and international trade. Provinces such as Alberta and Quebec are investing in hydrogen refueling networks and storage innovations for industrial and transportation applications. As Canada’s Hydrogen Strategy aims to make the nation a global hydrogen supplier, advanced storage and transportation infrastructure are expanding rapidly.

Companies Dominating the Hydrogen Storage Tanks and Transportation Landscape

- NPROXX

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Linde plc

- Air Products and Chemicals, Inc.

- Hexagon Purus

- Worthington Industries

- Luxfer Holdings PLC

- McPhy Energy S.A.

- Chart Industries, Inc.

- Plug Power Inc.

- Praxair, Inc.

- Air Liquide

- Luxfer Gas Cylinders

- VRV S.p.A.

- HBank Technologies Inc.

- Quantum Fuel Systems LLC

- Holtec International

- Cella Energy Limited

The hydrogen storage tanks and transportation market is dominated by key players who specialize in high-pressure composite tanks and transportation solutions. Companies are expanding their hydrogen infrastructure, including liquefied storage and distribution networks. With increasing government funding and private sector investments, competition is intensifying, driving innovations in lightweight materials, cost-effective storage, and safety technologies.

Here are some leading players in the market:

In the News

- In December 2023, Voith Composites’ 700 bar type IV 350-liter capacity hydrogen tank received approval for on-road use under United Nations Economic Commission for Europe guidelines (UNECE R 134). This approval is an important step towards making hydrogen-powered transportation more efficient and environmentally friendly.

- In February 2022, Chiyoda Corporation announced that the Advanced Hydrogen Energy Chain Association for Technology Development (AHEAD) successfully transported hydrogen overseas in the form of methylcyclohexane (MCH) using a chemical tanker.

Author Credits: Dhruv Bhatia

- Report ID: 7470

- Published Date: Apr 04, 2025

- Report Format: PDF, PPT